Specialist Guidance: Bagley Risk Management Techniques

Specialist Guidance: Bagley Risk Management Techniques

Blog Article

Key Elements to Think About When Deciding On Animals Threat Defense (LRP) Insurance Policy

When examining options for Livestock Threat Protection (LRP) insurance policy, a number of essential variables call for careful consideration to guarantee effective risk administration in the farming industry. Picking the best insurance coverage choices tailored to your certain animals operation is paramount, as is comprehending how superior prices correlate with the degree of protection provided.

Coverage Options

When considering Livestock Threat Protection (LRP) insurance coverage, it is essential to understand the different protection choices available to mitigate threats in the agricultural industry. Livestock Danger Security (LRP) insurance coverage offers various coverage options tailored to meet the diverse needs of livestock producers. Bagley Risk Management. One of the main protection choices is cost insurance coverage, which shields versus a decrease in market rates. Producers can choose the protection level that aligns with their price threat monitoring objectives, enabling them to protect their operations versus possible monetary losses.

An additional important coverage alternative is the endorsement period, which figures out the size of time the protection holds. Producers can pick the endorsement duration that finest suits their manufacturing cycle and market conditions. Additionally, insurance coverage levels and rates differ based on the kind of livestock being guaranteed, providing producers the adaptability to customize their insurance prepares according to their particular needs.

Comprehending the different insurance coverage choices readily available under Animals Risk Security (LRP) insurance is crucial for producers to make educated choices that efficiently protect their livestock operations from market unpredictabilities.

Premium Costs

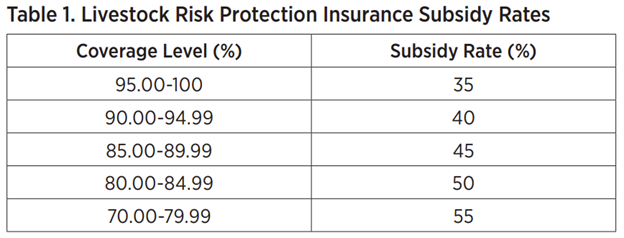

Livestock Risk Protection (LRP) insurance policy supplies necessary protection options customized to alleviate risks in the agricultural field, with a considerable aspect to take into consideration being the computation and framework of premium expenses. These include the kind and number of livestock being insured, the insurance coverage level chosen, the existing market costs, historic cost data, and the size of the protection period.

Premium prices for LRP insurance coverage are generally computed based on actuarial information and run the risk of assessment versions. Insurance providers analyze historic data on livestock rates and production prices to identify an ideal premium that mirrors the level of danger involved. It is necessary for livestock producers to carefully examine premium prices and protection alternatives to ensure they are effectively protected versus possible financial losses as a result of unfavorable market problems or unforeseen events. By recognizing how superior prices are computed and structured, producers can make informed choices when selecting the ideal LRP insurance coverage plan for their procedure.

Qualified Animals

The resolution of qualified animals for Animals Risk Protection (LRP) insurance policy coverage entails careful consideration of details standards and features. Animals kinds that are normally qualified for LRP insurance coverage include feeder cattle, fed cattle, swine, and lambs. These animals must fulfill particular credentials connected to weight varieties, age, and meant use. In addition, the qualification of livestock may differ based upon the certain insurance policy supplier and the terms of the policy.

Feeder cattle, for example, are commonly eligible for LRP insurance coverage if they fall within defined weight varieties. Fed cattle might also be eligible, but they need to meet particular weight and quality grade needs. Swine eligible for coverage generally include market weight animals intended for slaughter. Lambs are an additional classification of animals that can be taken into consideration for LRP insurance coverage, with variables such as weight and age playing a vital role in identifying their qualification.

Prior to picking LRP insurance coverage for livestock, manufacturers should very carefully assess the eligibility requirements laid out by the insurance copyright to ensure their animals satisfy the needed demands for insurance coverage.

Policy Adaptability

Policy adaptability in Animals Risk Protection (LRP) insurance coverage enables manufacturers to customize protection to suit their particular requirements and take the chance of administration approaches. This versatility empowers animals manufacturers to personalize their insurance policy policies based on factors such as the kind of animals they possess, market conditions, and private threat resistance levels. One crucial facet of plan versatility in LRP insurance policy is the ability to select protection levels that align with the manufacturer's financial goals and run the risk of direct exposure. Manufacturers can pick coverage degrees that secure them versus potential losses because of variations in livestock prices, guaranteeing they are appropriately insured without overpaying for unneeded coverage. Furthermore, LRP insurance supplies flexibility in policy duration, allowing producers to select protection durations that best fit their manufacturing cycles and advertising and marketing timelines. By providing customizable alternatives, LRP insurance enables manufacturers to efficiently handle their threat direct exposure while safeguarding their animals operations against unexpected market volatility.

Insurance Claims Refine

Upon experiencing a loss or damages, manufacturers can start the insurance claims process for their Livestock Danger Defense (LRP) insurance policy by quickly calling their insurance coverage provider. It is crucial for producers to report the loss as soon as feasible to expedite the insurance claims process. When getting to out to the insurance supplier, manufacturers look at this web-site will require to offer comprehensive info concerning the event, consisting of the day, nature of the loss, and any kind of pertinent documentation such as veterinary documents or market rates.

After the analysis is complete, the insurance copyright will certainly choose concerning the case and connect the end result to the producer. If the claim is approved, the manufacturer will get payment according to the terms of their Livestock Threat Security (LRP) insurance coverage. Bagley Risk Management. It is important for producers to be aware of the claims procedure to ensure a smooth experience in case of a loss

Verdict

Finally, when choosing Livestock Risk Defense (LRP) insurance, it is vital to consider coverage options, premium expenses, eligible livestock, policy flexibility, and the insurance claims process. These crucial factors will help make certain that farmers and breeders are properly secured against potential dangers and losses related to their livestock procedures. Making an educated choice based on these factors to consider can eventually bring about much better monetary safety and security and satisfaction for livestock manufacturers.

Animals Risk Defense (LRP) insurance policy offers different coverage alternatives customized to fulfill the diverse requirements of animals producers.The determination of eligible animals for Animals Risk Security (LRP) insurance coverage includes mindful consideration of certain criteria and characteristics.Policy versatility in Livestock Risk Protection (LRP) insurance allows manufacturers to customize coverage to suit their certain needs and run the risk of monitoring approaches.Upon experiencing a loss or damage, manufacturers can start the cases procedure for their Animals Risk Security (LRP) insurance by immediately calling their insurance service provider.In final thought, when choosing Livestock Risk Security (LRP) insurance, it is essential to take into consideration protection choices, premium prices, eligible animals, plan flexibility, and the cases you can look here process.

Report this page